Understanding Crypto Scams and Their Impact

In the rapidly evolving cryptocurrency landscape of 2025, scams have become an unfortunate reality for investors. Numerous types of scams exist, each employing different tactics to exploit the naive and uninformed. Among the most notorious are Ponzi schemes, phishing attacks, and fake exchanges. Ponzi schemes often promise high returns on investment, luring individuals with the promise of quick wealth. These scams rely on recruiting new investors to pay returns to earlier investors, creating an unsustainable cycle that ultimately collapses, leaving many without their assets.

Phishing attacks have also surged in popularity, where scammers impersonate legitimate platforms or services to deceive users into revealing personal information or private keys. These attacks can occur through emails, fraudulent websites, or even social media platforms. The immediacy and accessibility of the online environment amplify the risk, making it imperative for individuals to remain vigilant and scrutinize the sources of information they engage with.

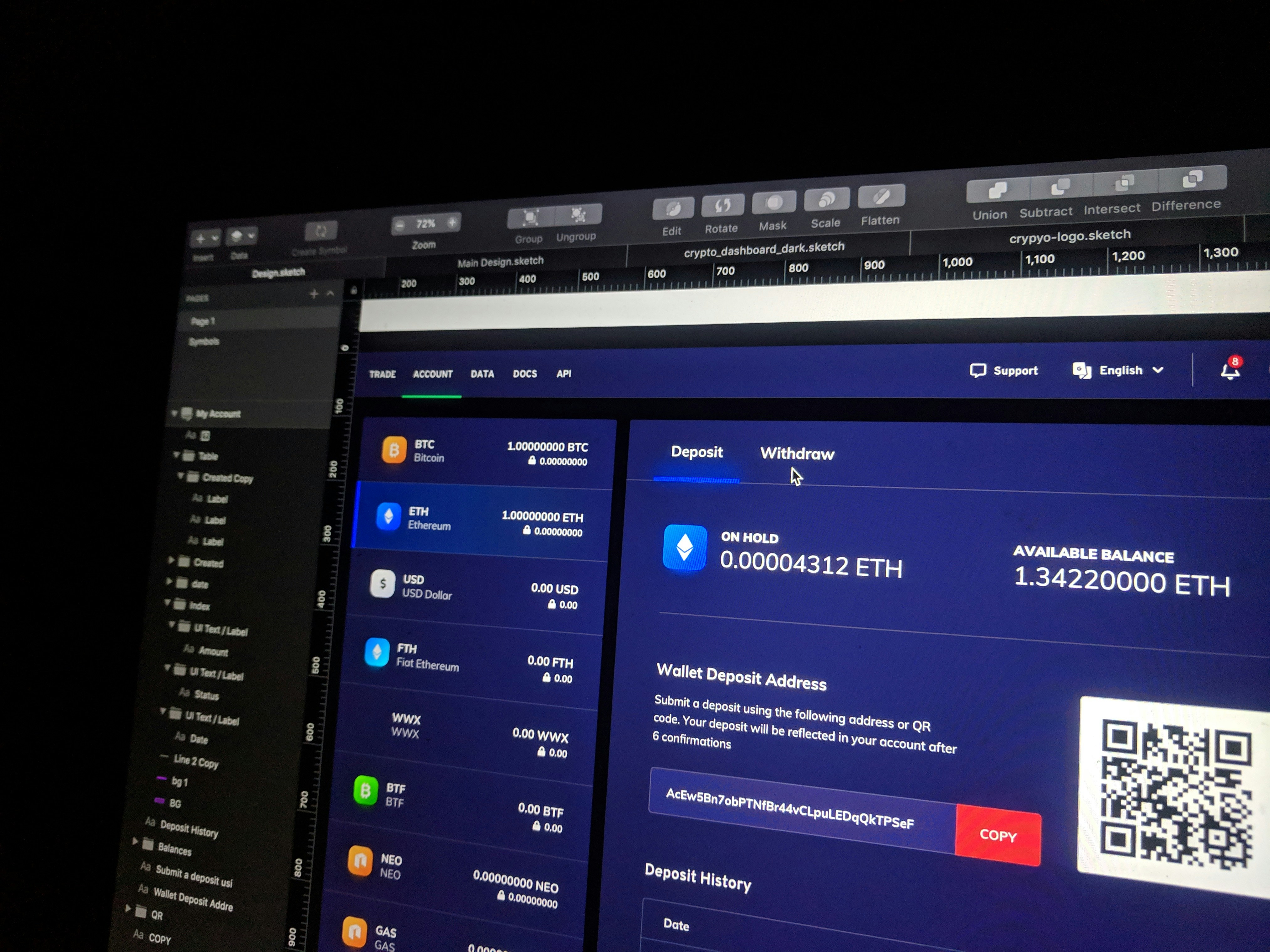

Furthermore, fake exchanges pose significant dangers, often mimicking the interface and functionalities of well-known cryptocurrency platforms to lure traders. By placing trust in these illegitimate exchanges, users risk losing their cryptocurrencies and the ability to recover their investments. The emotional toll on victims can be substantial, encompassing feelings of betrayal, anger, and helplessness. Financially, the repercussions can be severe, leading to the depletion of savings and the loss of financial security.

Real-life examples abound, with victims sharing their stories of lost investments and the trust that was shattered. One notable case involved a group of investors drawn into a Ponzi scheme that promised unrealistic returns, only to watch their funds vanish as the operators absconded with the money. Such scenarios underscore the significance of recognizing fraudulent activities early on and highlight the urgency required in safeguarding one’s investments amid the complexities of the cryptocurrency ecosystem.

Identifying and Reporting Crypto Crimes

The first step for individuals who suspect they have fallen victim to a cryptocurrency scam is to identify the nature of the scam. This may involve researching common types of fraud prevalent within the crypto landscape, such as phishing attacks, Ponzi schemes, or fake initial coin offerings (ICOs). Victims should take note of unusual account activities, suspicious communications, or promises of high returns with minimal risk, as these are often red flags indicative of a scam.

It is crucial to gather evidence to support any claims of a scam. Victims should document transactions in detail, including transaction IDs, wallets involved, names of individuals or entities, and any correspondence that occurred. Screenshots of websites, emails, or messages that prompted investment or provided misleading information can serve as valuable proof. Organizing this information systematically will facilitate the reporting process and potentially aid in the recovery of lost assets.

Time is of the essence when it comes to reporting crypto crimes. Authorities typically prefer prompt notifications to increase the chances of recovering assets or apprehending perpetrators. Victims should report the incident to local law enforcement as well as specialized agencies that focus on cybercrime or financial fraud, such as the Internet Crime Complaint Center (IC3) or the Federal Trade Commission (FTC). Furthermore, notifying the cryptocurrency exchange through which the scam was executed can help halt any further fraudulent transactions.

When reporting a crypto-related crime, accuracy in the recorded details is vital. Providing comprehensive and precise information aids law enforcement and regulatory bodies in their investigations and can significantly improve recovery outcomes. Overall, approaching the situation with diligence and promptness can enhance the prospects of recovering lost funds while aiding in the greater fight against cryptocurrency scams.

Leveraging Asset Chain Recovery (ACR) Solutions

As cryptocurrency continues to evolve, the risks associated with scams and fraud have also multiplied. Victims of crypto scams often feel devastated and uncertain about their next steps. However, Asset Chain Recovery (ACR) solutions have emerged as a beacon of hope for those looking to recover lost assets. These solutions offer a structured approach to tracing and reclaiming funds stolen through fraudulent means. ACR specialists utilize innovative methodologies to track assets on the blockchain, which is critical given that many crypto transactions are designed to be irreversible.

The first step in the ACR process typically involves asset tracing. Specialists employ advanced analytics and blockchain forensic tools to identify the pathways taken by the misappropriated funds. By analyzing transaction histories, they can establish connections between wallets and exchanges, enabling them to pinpoint the current location of the stolen assets. This methodical approach is crucial, as many victims may not know where to begin their recovery efforts.

Communication with cryptocurrency exchanges is another vital component of the ACR process. After tracing the assets, ACR experts initiate discussions with the relevant exchanges to freeze or recover the hacked funds. Many exchanges have fraud detection protocols in place and are willing to cooperate with authorities and recovery specialists. Collaborating with law enforcement agencies is equally important, as ACR specialists can provide them with the necessary documentation and evidence to facilitate legal actions against the perpetrators.

Success stories abound, demonstrating the effectiveness of ACR solutions. Numerous cases have been documented where victims have managed to recover a significant portion of their lost assets thanks to these specialists. The combination of sophisticated tracking, exchange negotiation, and law enforcement collaboration has proven to be successful in restoring faith in the crypto ecosystem. This reassurance serves as a powerful reminder that while the threat of scams is very real, the availability of Asset Chain Recovery solutions offers a pathway to recovery for victims.

Protecting Yourself to Prevent Future Scams

Ensuring the safety of your cryptocurrency investments necessitates proactive measures aimed at averting potential scams. Individuals interested in the crypto space should adopt a discerning approach to conducting due diligence on projects before committing any assets. Essential steps include investigating the project’s team, examining whitepapers, and assessing online presence and community feedback. Authentic projects usually have transparent and verifiable information about their developers and operational framework. Therefore, a careful examination of these factors may unveil red flags that are crucial in identifying deceptive schemes.

Moreover, being aware of current scam tactics is vital. Scammers continuously evolve their strategies, creating new ways to exploit unsuspecting investors. Engaging with credible sources that track known scams and emerging fraudulent activities will enhance your knowledge and preparedness. Resources such as cryptocurrency security forums, social media channels, and professional networks can provide invaluable insights into typical patterns of scams. Additionally, subscribing to newsletters and updates from recognized crypto security experts will keep you informed about potential vulnerabilities and best practices for safeguarding your assets.

The importance of community engagement cannot be understated. Participating in forums and discussion groups enables investors to share experiences, strategies, and knowledge regarding crypto security. This communal knowledge sharing fosters an environment where individuals may learn from one another, thus enhancing their awareness of existing and forthcoming scam methods. Encouraging open discussions about personal experiences and lessons learned further empowers individuals as they navigate the complexities of cryptocurrency investments.

Lastly, it is prudent to employ a multi-faceted approach to security by using hardware wallets, enabling two-factor authentication (2FA), and adopting best practices related to password management. By implementing these measures and remaining vigilant, investors can significantly reduce their risk of falling victim to scams while engaging in the evolving world of cryptocurrency.

Leave a Reply